This in-depth market data research is split into two key modules: Market Growth Outlook and Competitive Analysis. Each of these modules is further configured into several sub-modules to meet the needs of executives as well as marketing, sales, and product development managers. All of these modules and sub-modules may be purchased as a bundle or separately. A brief description of these modules, sub-modules, and their use cases is included below.

The Industrial Cellular Routers research delivers current market analysis plus a five-year market and technology forecast. The research is available in multiple editions including worldwide, all regions, and most major countries.

Industrial Cellular Routers Market: Users Contend with Rapid Cellular Tech Evolution

ARC Advisory Group’s research in industrial cellular routers shows that the beginning of large-scale 5G deployment, promise of private cellular networks, and edge computing are reshaping the industrial cellular routers market. With its high speed, low latency, and massive IoT device capacity, 5G connectivity holds immense potential for industrial applications. Current deployment is small, but will expand in future years as components become more widely available and highly anticipated 5G features enter the market. Private networks are a promising technology that offer enterprises greater control over their assets and data while increasing network reliability and uptime, but adoption has been slow as users grapple with the cost and complexity of these installations. Edge computing is increasingly a part of the value proposition of the industrial edge, and the processing power and edge computing capacity of industrial routers continues to increase.

Industrial Cellular Routers Market Strategic Issues

In addition to providing a five-year market forecast, the Industrial Cellular Routers market research provides detailed quantitative current market data and addresses key strategic issues as follows.

In addition to providing a five-year market forecast, the Industrial Cellular Routers market research provides detailed quantitative current market data and addresses key strategic issues as follows.

Business Outcome-oriented Approach to Cellular Adoption

As the power of cellular devices grows, it is critical to approach their adoption with a well-defined plan to achieve value. Cellular technology is indispensable for ensuring reliable connectivity and communication in industrial settings, but it can be complex and costly compared to alternatives.

Ensure Device Longevity Encompasses the Full Length of Desired Equipment Lifecycle

Exercise due diligence in ensuring that purchased hardware and supporting software align with projected equipment lifecycles. Applications with lengthy lifecycles should consider offerings that include long-term support for firmware updates, security improvements, and device and network management.

Future Proof Connectivity and Compute Strategy

Ensure edge solutions provide the requisite north and southbound connectivity consistent with your current and anticipated installations; particularly anticipated improvements for 5G and WiFi. Consistent edge connectivity is critical for all data sources: hardware, sensors, devices, cloud, data visualization, analytics, security, management, etc. MQTT, OPC UA, RestAPIs, and other standard technologies are the primary means of achieving edge-to-cloud connectivity. Ensure current and future edge compute requirements are aligned with the capabilities of the chosen devices’ CPU, memory, OS, and support for containers.

Large-scale Cellular Deployments Require a Device and Network Management Strategy

Determine the level of network management your operations can support. Pilots and installations with only a few cellular devices might not require much overhead, but effective scalability must be a consideration as the number of devices in the network increases. Look to the growing number of software and services designed to manage network traffic, automatically apply firmware updates, and provision new devices.

ARC’s market growth outlook service delivers an in-depth market opportunity analysis including five-year market and technology forecasts and 3-year history trend lines where available. Besides providing an in-depth analysis of the market opportunity provided by each technology, this service allows technology suppliers to analyze their own customized markets consisting of multiple technologies. For example, customers can view different market scenarios by adding or removing technology markets from the analysis, providing them a Total Available Market (TAM) view of their own served market. A list of the available market growth outlook services can be seen in the list below.

This service is designed to help accelerate your organization's ability to understand an up-to-date view of the market opportunity provided by your current product portfolio and analyze how your company’s market opportunity would change if you were to acquire or divest a particular product line. The service will also help you identify and capitalize on emerging markets, whether these markets are based on an emerging technology, region, vertical industry, or application. Built upon a proprietary market model and ARC’s field proven primary research, this service helps product and marketing managers optimize their business plans by identifying the opportunities provided by emerging trends. ARC’s reputation as the preeminent independent provider of market growth opportunity analyses for nearly four decades also provides greater weight to your business plans. ARC’s market growth outlook services are available in a variety of formats depending on whether you view your market opportunities via different technologies, industries, or world regions.

In addition, ARC has a strong history of providing customized market opportunity reports and services to meet your specific needs. For example, you may sell your products only to specific industries and/or in only one or two regions. You tell us your served markets and ARC can quickly configure a report or service designed to best serve your served market.

ARC provides several versions of these reports and services depending on your role in the organization. Executive Views are high level market opportunities designed to help executives quickly identify key trends and market opportunities around the world. In-depth market opportunity analyses provide marketing and product managers more detailed technology specific market information to plan marketing and product development strategies. The following table shows more specific information included in each version.

| Market Growth Outlook Analysis | Use Cases | Target Role |

| Worldwide Market Growth Outlook by Industry & Region with 3-year history where available | In-depth technology-specific strategic growth planning across multiple technologies, applications, regions, and industries | Product & Marketing Managers |

| Worldwide Industry Growth Outlook by Region with 3-year history where available | Strategic technology growth planning for markets defined by a single or multiple vertical industries | Industry Managers |

| Regional/Country Market Growth Outlook by Technology & Industry with 3-year history where available (includes country data) | Strategic technology growth planning for markets defined by a single or multiple world regions | Regional & Country Sales Managers |

| Market Growth Outlook Executive View | Strategic Total Available Market (TAM) growth planning dashboard covering multiple vertical industries, technologies, and world regions | Executives |

ARC’s Competitive Analysis services deliver in depth competitive analyses across multiple technologies, applications, regions, and industries. Besides providing an in-depth analysis of the market opportunity provided by each technology, this service allows technology suppliers to analyze their own customized markets consisting of multiple technologies. For example, customers can view different market scenarios by adding or removing technology markets from the analysis, providing them a Total Available Market (TAM) view of their own served market. A list of the available market growth outlook services can be seen in the list below.

This service is designed to help product and marketing managers identify their company’s market positioning across multiple views within their Serviceable Available Market (SAM). Built upon a proprietary market model and ARC’s field proven primary research, this service helps product and marketing managers optimize their business plans by identifying how their company’s market position would change if the company were to acquire or divest a particular product line or technology. ARC’s reputation as the preeminent independent provider of competitive market benchmarking for nearly four decades lends greater weight to your business plans. ARC’s market competitive services are available in a variety of formats depending on whether you view your market opportunities via different technologies, industries, or world regions.

In addition, ARC has a strong history of providing customized market opportunity reports and services to meet the specific needs of our clients. For example, you may sell your products only to specific industries and/or in only one or two regions. You tell us your served markets and ARC can quickly configure a report or service designed to best serve your served market.

ARC provides several versions of these reports and services depending on your role in the organization. Executive Views are high level market competitive analyses designed to help executives quickly assess their SAM by world region, technology, or vertical industry. In-depth competitive market analyses provide marketing and product managers more detailed technology specific benchmarking information to plan marketing and product development strategies. The following table shows more specific information included in each version.

| Competitive Analysis | Use Cases | Target Role |

| Worldwide Competitive Analysis by Technology | In-depth competitive market analysis that quantifies how your company’s market position has changed over time across multiple technologies, applications, regions, and industries | Product & Marketing Managers |

| Worldwide Competitive Analysis by Industry | Strategic technology-based competitive analyses for markets defined by a single or multiple vertical industries | Industry Managers |

| Regional/Country Competitive Analysis by Industry | Strategic technology-based competitive analyses for markets defined by a single or multiple world regions | Regional Sales Managers |

| Competitive Analysis Executive View | Strategic Serviceable Available Market (SAM) analysis dashboard covering multiple vertical industries, technologies, and world regions | Executives |

Worldwide Research Focus Areas

Strategic Analysis

- Major Trends

- Regional Trends

- Strategic Recommendations

Competitive Analysis

- Market Shares of the Leading Suppliers

- Market Shares by Region

- North America

- Europe, Middle East, Africa

- Asia

- Latin America

- Market Shares by Industry

- Automotive

- Buildings

- Electric Power Generation

- Electric Power T&D

- In-Vehicle

- Machinery

- Oil & Gas

- Transportation & Logistics

- Water & Wastewater

- Other Industries

- Market Shares by Revenue Category:

- Hardware Revenues

- Service Revenues

- Software Revenues

- Market Shares by Cellular Technology

- 3G/2G

- 4G LTE

- 5G

- Market Shares by Network Ownership

- Private

- Public

- Market Shares by Configuration

- Fixed

- Mobile

- Market Shares by Form Factor

- DIN Rail

- Rack/Panel Mount

- Market Shares by Installation Type

- Market Shares by Operating System

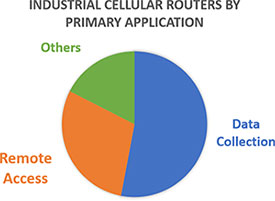

- Market Shares by Primary Function

- Market Shares by CPU Type

- Market Shares by Edge to Cloud Integration

- Market Shares by Edge Computing Use

- Market Shares by C1 Div2 Rating

- Market Shares by EN 50155 Rating

- Market Shares by IEC 61850-3 Rating

- Market Shares by Environmental Rating

- Market Shares by ATEX Rated

- Market Shares by 5G Hardware Release

- Market Shares by Customer Type

- Market Shares by Sales Channel

Market Forecast

- Total Shipments of Industrial Cellular Routers

- Shipments by Region

- North America

- Europe, Middle East, Africa

- Asia

- Latin America

- Shipments by Revenue Category

- Hardware Revenues

- Service Revenues

- Software Revenues

- Shipments by Industry

- Automotive

- Buildings

- Electric Power Generation

- Electric Power T&D

- In-Vehicle

- Machinery

- Oil & Gas

- Transportation & Logistics

- Water & Wastewater

- Other Industries

- Shipments by Cellular Technology

- 3G/2G

- 4G LTE

- 5G

- Shipments by Network Ownership

- Private

- Public

- Shipments by Configuration

- Fixed

- Mobile

- Shipments by Form Factor

- DIN Rail

- Rack/Panel Mount

- Shipments by Installation Type

- Shipments by CPU Type

- Shipments by ATEX Rated

- Shipments by Operating System

- Shipments by Primary Function

- Shipments by Edge to Cloud Integration

- Shipments by Edge Computing Use

- Shipments by C1 Div2 Rating

- Shipments by EN 50155 Rating

- Shipments by IEC 61850-3 Rating

- Shipments by Environmental Rating

- Shipments by by 5G Hardware Release

- Shipments by Sales Channel

- Shipments by Customer Type

Industry Participants

The research identifies all relevant suppliers serving this market.

Regional Research Focus Areas

Strategic Analysis

Competitive Analysis

- Leading Suppliers in Region

- Industry Shares in Region

- Country Shares in Region

- Leading Suppliers by Industry

Market Forecasts

- Market Forecast by Country

- Market Forecast by Industry

List of countries included in each region: MIRA-Country

For More Information

To speak with the author or to purchase the Industrial Cellular Routers Market Research, please contact us.

Learn more about ARC In-depth Research at Market Analysis

Learn more about ARC Strategic Services at Advisory Services for Industry Leaders