The final rules require companies to disclose material climate-related risks, activities to mitigate or adapt to such risks, information about the board of directors' oversight of climate-related risks, and management’s role in managing material climate-related risks. Additionally, companies must disclose any climate-related targets or goals that are material to their business, results of operations, or financial condition.

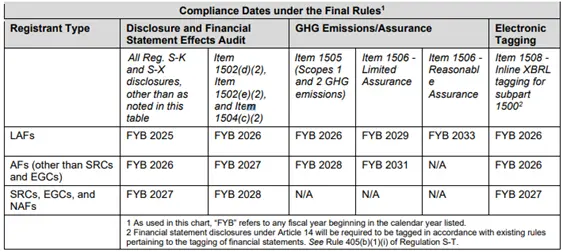

Certain larger companies must also disclose their Scope 1 and/or Scope 2 greenhouse gas emissions, file an attestation report covering the required disclosure of such emissions, and disclose the financial statement effects of severe weather events and other natural conditions. The final rules include a phased-in compliance period, with the compliance date dependent on the company’s filer status and the content of the disclosure.

Climate-related disclosures have become increasingly important for investors as they recognize the impact of climate-related risks on a company's financial performance and position. The final rules are a continuation of the Commission's efforts to provide investors with more consistent, comparable, and reliable information about the financial effects of climate-related risks on a company's business and how the company manages those risks.

The final rules will require registrants to disclose:

Climate-related risks that have had or are reasonably likely to have a material impact on the registrant’s business strategy, results of operations, or financial condition.

The actual and potential material impacts of any identified climate-related risks on the registrant’s strategy, business model, and outlook.

If, as part of its strategy, a registrant has undertaken activities to mitigate or adapt to a material climate-related risk, a quantitative and qualitative description of material expenditures incurred and material impacts on financial estimates and assumptions that directly result from such mitigation or adaptation activities.

Specified disclosures regarding a registrant’s activities, if any, to mitigate or adapt to a material climate-related risk including the use, if any, of transition plans, scenario analysis, or internal carbon prices.

Any oversight by the board of directors of climate-related risks and any role by management in assessing and managing the registrant’s material climate-related risks.

Any processes the registrant has for identifying, assessing, and managing material climate-related risks and, if the registrant is managing those risks, whether and how any such processes are integrated into the registrant’s overall risk management system or processes.

Information about a registrant’s climate-related targets or goals, if any, that have materially affected or are reasonably likely to materially affect the registrant’s business, results of operations, or financial condition. Disclosures would include material expenditures and material impacts on financial estimates and assumptions as a direct result of the target or goal or actions taken to make progress toward meeting such target or goal.

For large accelerated filers (LAFs) and accelerated filers (AFs) that are not otherwise exempted, information about material Scope 1 emissions and/or Scope 2 emissions.

For those required to disclose Scope 1 and/or Scope 2 emissions, an assurance report at the limited assurance level, which, for an LAF, following an additional transition period, will be at the reasonable assurance level.

The capitalized costs, expenditures expensed, charges, and losses incurred as a result of severe weather events and other natural conditions, such as hurricanes, tornadoes, flooding, drought, wildfires, extreme temperatures, and sea level rise, subject to applicable one percent and de minimis disclosure thresholds, disclosed in a note to the financial statements.

The capitalized costs, expenditures expensed, and losses related to carbon offsets and renewable energy credits or certificates (RECs) if used as a material component of a registrant’s plans to achieve its disclosed climate-related targets or goals, disclosed in a note to the financial statements.

If the estimates and assumptions a registrant uses to produce the financial statements were materially impacted by risks and uncertainties associated with severe weather events and other natural conditions or any disclosed climate-related targets or transition plans, a qualitative description of how the development of such estimates and assumptions was impacted, disclosed in a note to the financial statements.

The final rule will become effective 60 days after publication in the Federal Register, and compliance will be phased in as follows: