This in-depth market data research is split into two key modules: Market Growth Outlook and Competitive Analysis. Each of these modules is further configured into several sub-modules to meet the needs of executives as well as marketing, sales, and product development managers. All of these modules and sub-modules may be purchased as a bundle or separately. A brief description of these modules, sub-modules, and their use cases is included below.

This Automation and Software Expenditures for the Process Industries Market Research delivers current market analysis plus a five year market and technology forecast.

Sustainability Initiatives Drive Process Automation Market Growth

According to ARC Advisory Group research, the outlook for the process automation marketplace remains positive for capital investments in automation products and software. Despite supply chain challenges, ongoing economic uncertainty, and rising energy and the prices of raw materials, capital investments in process industries in the global market provided some pockets of opportunity for suppliers. Governments around the world showed an increasing appetite toward investing to become less dependent on unreliable foreign suppliers of energy. This increased focus on energy and security have driven increased investment activity in nuclear, LNG, and even fossil fuel power plants.

Process Automation Expenditures Market Strategic Issues

In addition to providing a five-year market forecast, the Total Automation Expenditures for Process market research provides detailed quantitative current market data and addresses key strategic issues as follows.

In addition to providing a five-year market forecast, the Total Automation Expenditures for Process market research provides detailed quantitative current market data and addresses key strategic issues as follows.

Use Ethernet Connectivity for Greater Process Insight

Ethernet connection is generating a lot of interest in both the user and supplier communities. Ethernet offers many benefits—lower total cost of ownership (TCO), improved adaptability, better security, widespread availability, and market familiarity. It offers improved connectivity and functionality, allowing for easier access to measurement information. In recent years, networking technology has also overcome many of its disadvantages that hindered adoption in the industrial world. Using fiber-optic cables, Ethernet can be deployed for longer distances. Ethernet switches for hazardous areas are available and users also have the option of Power over Ethernet (PoE), so there is no need to run additional lines for power supply. In the process world, Ethernet can now connect a wide range of field instruments, including flowmeters, to a central control system.

Leverage Machine Learning and Artificial Intelligence

Industrial analytics is currently primarily focused on machine learning, a branch of artificial intelligence (AI) that uses algorithms to mimic human recognition. Machine learning is often combined with AI for applications like chatbots and natural language processing. However, labeling machine learning as "AI" or "AI and machine learning" can cause confusion. Machine learning is widely used in manufacturing for predictive analytics, using supervised techniques for identification and unsupervised learning for pattern discovery. It excels in recognizing patterns and predicting behaviors in large datasets without explicit instructions, crucial in asset-intensive settings with varying operating conditions. In discrete manufacturing, machine learning has brought numerous advantages, such as a 40 percent reduction in scrap by identifying inefficiencies and 90 percent accurate detection of quality issues in motorcycle manufacturing, allowing for early detection and prevention of problems.

Utilize Connected Machines and Production Lines

As more machines and production lines become networked, maintenance and operational data play a crucial role in assessing industrial processes. This data is accessible to both manufacturers and machine builders, allowing them to optimize performance and redefine machine functionality through software updates. Manufacturers can enhance product design and production procedures, contributing to the next generation of goods and machinery. This concept is referred to as closed-loop manufacturing. Machine builders' role in providing maintenance services will increase, ushering in the era of software-defined machines. Standards for smooth information transfer between manufacturing equipment, inspection, and product design are essential for the model-based enterprise, as they facilitate smart production and innovation.

ARC’s market growth outlook service delivers an in-depth market opportunity analysis including five-year market and technology forecasts and 3-year history trend lines where available. Besides providing an in-depth analysis of the market opportunity provided by each technology, this service allows technology suppliers to analyze their own customized markets consisting of multiple technologies. For example, customers can view different market scenarios by adding or removing technology markets from the analysis, providing them a Total Available Market (TAM) view of their own served market. A list of the available market growth outlook services can be seen in the list below.

This service is designed to help accelerate your organization's ability to understand an up-to-date view of the market opportunity provided by your current product portfolio and analyze how your company’s market opportunity would change if you were to acquire or divest a particular product line. The service will also help you identify and capitalize on emerging markets, whether these markets are based on an emerging technology, region, vertical industry, or application. Built upon a proprietary market model and ARC’s field proven primary research, this service helps product and marketing managers optimize their business plans by identifying the opportunities provided by emerging trends. ARC’s reputation as the preeminent independent provider of market growth opportunity analyses for nearly four decades also provides greater weight to your business plans. ARC’s market growth outlook services are available in a variety of formats depending on whether you view your market opportunities via different technologies, industries, or world regions.

In addition, ARC has a strong history of providing customized market opportunity reports and services to meet your specific needs. For example, you may sell your products only to specific industries and/or in only one or two regions. You tell us your served markets and ARC can quickly configure a report or service designed to best serve your served market.

ARC provides several versions of these reports and services depending on your role in the organization. Executive Views are high level market opportunities designed to help executives quickly identify key trends and market opportunities around the world. In-depth market opportunity analyses provide marketing and product managers more detailed technology specific market information to plan marketing and product development strategies. The following table shows more specific information included in each version.

| Market Growth Outlook Analysis | Use Cases | Target Role |

| Worldwide Market Growth Outlook by Industry & Region with 3-year history where available | In-depth technology-specific strategic growth planning across multiple technologies, applications, regions, and industries | Product & Marketing Managers |

| Worldwide Industry Growth Outlook by Region with 3-year history where available | Strategic technology growth planning for markets defined by a single or multiple vertical industries | Industry Managers |

| Regional/Country Market Growth Outlook by Technology & Industry with 3-year history where available (includes country data) | Strategic technology growth planning for markets defined by a single or multiple world regions | Regional & Country Sales Managers |

| Market Growth Outlook Executive View | Strategic Total Available Market (TAM) growth planning dashboard covering multiple vertical industries, technologies, and world regions | Executives |

ARC’s Competitive Analysis services deliver in depth competitive analyses across multiple technologies, applications, regions, and industries. Besides providing an in-depth analysis of the market opportunity provided by each technology, this service allows technology suppliers to analyze their own customized markets consisting of multiple technologies. For example, customers can view different market scenarios by adding or removing technology markets from the analysis, providing them a Total Available Market (TAM) view of their own served market. A list of the available market growth outlook services can be seen in the list below.

This service is designed to help product and marketing managers identify their company’s market positioning across multiple views within their Serviceable Available Market (SAM). Built upon a proprietary market model and ARC’s field proven primary research, this service helps product and marketing managers optimize their business plans by identifying how their company’s market position would change if the company were to acquire or divest a particular product line or technology. ARC’s reputation as the preeminent independent provider of competitive market benchmarking for nearly four decades lends greater weight to your business plans. ARC’s market competitive services are available in a variety of formats depending on whether you view your market opportunities via different technologies, industries, or world regions.

In addition, ARC has a strong history of providing customized market opportunity reports and services to meet the specific needs of our clients. For example, you may sell your products only to specific industries and/or in only one or two regions. You tell us your served markets and ARC can quickly configure a report or service designed to best serve your served market.

ARC provides several versions of these reports and services depending on your role in the organization. Executive Views are high level market competitive analyses designed to help executives quickly assess their SAM by world region, technology, or vertical industry. In-depth competitive market analyses provide marketing and product managers more detailed technology specific benchmarking information to plan marketing and product development strategies. The following table shows more specific information included in each version.

| Competitive Analysis | Use Cases | Target Role |

| Worldwide Competitive Analysis by Technology | In-depth competitive market analysis that quantifies how your company’s market position has changed over time across multiple technologies, applications, regions, and industries | Product & Marketing Managers |

| Worldwide Competitive Analysis by Industry | Strategic technology-based competitive analyses for markets defined by a single or multiple vertical industries | Industry Managers |

| Regional/Country Competitive Analysis by Industry | Strategic technology-based competitive analyses for markets defined by a single or multiple world regions | Regional Sales Managers |

| Competitive Analysis Executive View | Strategic Serviceable Available Market (SAM) analysis dashboard covering multiple vertical industries, technologies, and world regions | Executives |

Worldwide Research Focus Areas

Strategic Analysis

- Major Trends

- Executive Overview

- Buyer Strategies

- Supplier Strategies

- Growth Contributors and Inhibitors

Competitive Analysis

- Market Shares of the Leading Suppliers

- Market Shares by Region

- North America

- Europe, Middle East, Africa

- Asia

- Latin America

- Market Shares by Industry

- Cement & Glass

- Chemical

- Electric Power Generation

- Electric Power T&D

- Food & Beverage

- Metals

- Mining

- Oil & Gas

- Pharmaceutical & Biotech

- Pulp & Paper

- Refining

- Textiles

- Water & Wastewater

- Market Shares by Product

- AC Drives – Low Voltage

- AC Drives – Medium Voltage

- Advanced Process Control & Online Optimization

- Computer Numerical Controls

- Continuous Ultrasonic Level Devices

- Control Valves, Actuators, and Positioners

- DCS without SCADA

- Engineering Design Tools

- Enterprise Asset Management

- Field Service Management

- Flowmeters

- General Motion Control

- Human-Machine Interface Software

- Machine Safeguarding Solutions

- Manufacturing Execution Systems

- Operator Training Simulation Software

- Plant Asset Management

- Pressure Transmitters

- PLCs

- Process Safety Systems

- Process Simulation & Optimization

- Radar Level Devices

- SCADA Systems

- Temperature Transmitters

Market Forecasts

- Total Automation Expenditures for Process Industries

- Shipments by Region

- North America

- Europe, Middle East, Africa

- Asia

- Latin America

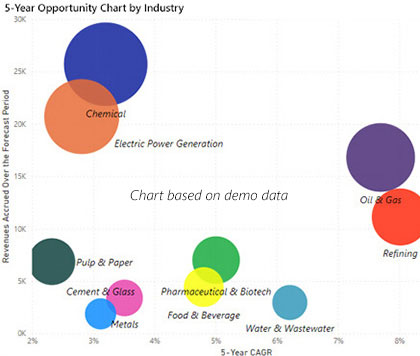

- Shipments by Industry

- Cement & Glass

- Chemical

- Electric Power Generation

- Electric Power T&D

- Food & Beverage

- Metals

- Mining

- Oil & Gas

- Pharmaceutical & Biotech

- Pulp & Paper

- Refining

- Textiles

- Water & Wastewater

- Shipments by Product

- AC Drives – Low Voltage

- AC Drives – Medium Voltage

- Advanced Process Control & Online Optimization

- Computer Numerical Controls

- Continuous Ultrasonic Level Devices

- Control Valves, Actuators, and Positioners

- DCS without SCADA

- Engineering Design Tools

- Enterprise Asset Management

- Field Service Management

- Flowmeters

- General Motion Control

- Human-Machine Interface Software

- Machine Safeguarding Solutions

- Manufacturing Execution Systems

- Operator Training Simulation Software

- Plant Asset Management

- Pressure Transmitters

- PLCs

- Process Safety Systems

- Process Simulation & Optimization

- Radar Level Devices

- SCADA Systems

- Temperature Transmitters

Industry Participants

The research identifies all relevant suppliers serving this market.

For More Information

To speak with the author or to purchase the Automation and Software Expenditures Market Research, please contact us.

Learn more about ARC In-depth Research at Market Data Services

Learn more about ARC Strategic Services at Advisory Services for Industry Leaders