This in-depth market data research is split into two key modules: Market Growth Outlook and Competitive Analysis. Each of these modules is further configured into several sub-modules to meet the needs of executives as well as marketing, sales, and product development managers. All of these modules and sub-modules may be purchased as a bundle or separately. A brief description of these modules, sub-modules, and their use cases is included below.

The Drone Inspection Services market research delivers current market analysis plus a five year market and technology forecast. It is available in multiple editions including worldwide, all regions, and most major countries. The research covers Unmanned Aerial Systems, Proprietary Drone Protocols, Autonomous Navigation, Flight Control Software, Unmanned Traffic Management Systems, AI, Machine Learning, Strategic Analysis, Market Size, 5 Year Forecast, Industry Trends.

Drone Inspection Services Are Taking Off in Many Industries

According to ARC Advisory Group research, demand for drone inspection services in companies operating in asset-intensive process industries will be robust as the desire to keep employees safe from working in inaccessible areas or confined spaces or completing dangerous tasks remains paramount for a growing number of companies and companies find outsourcing such operations an attractive option. The drone inspection service market is comprised of drone service providers deploying unmanned aerial systems or drones designed to operate in hard-to-reach areas and confined spaces and/or perform dangerous tasks in order to ensure employee safety, save time and money, and provide operational improvements via automation and digitalization.

Drone Inspection Services Strategic Issues

In addition to providing a five-year market forecast, the Drone Inspection Services market research provides detailed quantitative current market data and addresses key strategic issues as follows.

In addition to providing a five-year market forecast, the Drone Inspection Services market research provides detailed quantitative current market data and addresses key strategic issues as follows.

Carefully Review Specific Operational Requirements – The Right Drone Service for the Right Application

Users should fully understand what they need from a drone service in terms of level of autonomy desired or required; data collection and analytics capabilities, including AI and/or cloud computing capability; communications requirements such as WiFi, proprietary drone protocols, and 4G (or 5G pending); and drones’ ability to support. These are all important as they can help select the best drone service to meet their current and future application(s) requirements. Ease of integration of the drone’s API into the user’s existing inspection or asset management system and/or ability to integrate third-party application software or AI and machine learning on the drone are also important considerations.

Depending on the complexity of the task, the drone provider may require AI and machine learning to ensure autonomous navigation and operations such as automated inspections capability, equipment condition monitoring, and other tasks for which advanced functionality may be needed. Users that may require deploying a fleet of drones will want to ensure their service provider offers sufficient tools and capabilities to provide fleet management remotely and with ability to scale its requirements as necessary. Effective flight control software and reliance on unmanned traffic management systems (UTM) are also important considerations.

Ensure Drone Service Performance

Since drone service providers typically possess much greater expertise about drones but not necessarily industry-specific knowledge when it comes to harsh environments and the unique needs in oil & gas, end users should seek to select service providers that will act as a partner that is flexible and willing to innovate and iterate drone design and functionality as needed as they begin their journey into deploying drones in their unique operations. Some service providers offer drones that can be customized to meet a customer’s specific requirements in terms of sensor payloads deployed, advanced analytics and application software requirements, communications options such as 4G LTE (or soon 5G), Wi-Fi, and cloud access via a docking station. Users are advised to work closely with their service provider to ensure the drone can meet their specific application requirements, today and possibly in the future.

Consider Drone-as-a-Service as an Option

For those users that cannot afford to make the investment in a drone, or perhaps may be challenged to justify the investment and/or lack the internal resources to manage the integration and operations of inspection drones in the field, seeking out drone service providers or suppliers that offer Drone-as-a-Service (DaaS) is an option worth considering. DaaS can be a win-win for both the user and suppliers that have the necessary resources, R&D strength, and internal expertise (or a strong partner ecosystem) to fully support the user’s requirements.

Users benefit as they save on the initial upfront investment, avoid having to deal with maintenance issues, get ongoing software updates and support, and can scale operations as demand and need warrant, within limits of the contract. Shifting from a Capital Expenditures to an OpEx budget can shorten purchasing cycle and typically simplify ROI criteria; there is no need to train or hire drone experts; the customer enjoys a close partnership relationship with the supplier who is incentivized to design robust and reliable drones (since they are responsible to repair and/or replace) and keeps evolving and improving their hardware and software capabilities faster and more precisely in order to maintain a competitive advantage.

Drone service providers offer a complete outsourcing service, including providing automated inspections or surveying and mapping by experienced pilots and inspectors using drones they manufacture themselves. The user simply pays for the data collected and reporting and any analysis that may be requested or required. Drone manufacturers that manufacture drones but do not offer drone services will be covered in a separate study titled Drones for the Process Industries.

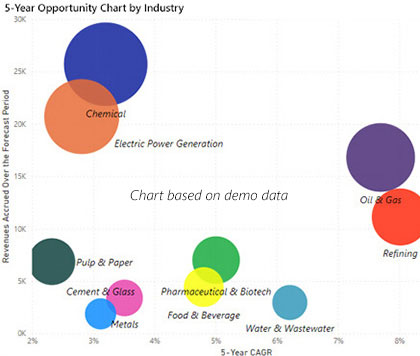

ARC’s market growth outlook service delivers an in-depth market opportunity analysis including five-year market and technology forecasts and 3-year history trend lines where available. Besides providing an in-depth analysis of the market opportunity provided by each technology, this service allows technology suppliers to analyze their own customized markets consisting of multiple technologies. For example, customers can view different market scenarios by adding or removing technology markets from the analysis, providing them a Total Available Market (TAM) view of their own served market. A list of the available market growth outlook services can be seen in the list below.

This service is designed to help accelerate your organization's ability to understand an up-to-date view of the market opportunity provided by your current product portfolio and analyze how your company’s market opportunity would change if you were to acquire or divest a particular product line. The service will also help you identify and capitalize on emerging markets, whether these markets are based on an emerging technology, region, vertical industry, or application. Built upon a proprietary market model and ARC’s field proven primary research, this service helps product and marketing managers optimize their business plans by identifying the opportunities provided by emerging trends. ARC’s reputation as the preeminent independent provider of market growth opportunity analyses for nearly four decades also provides greater weight to your business plans. ARC’s market growth outlook services are available in a variety of formats depending on whether you view your market opportunities via different technologies, industries, or world regions.

In addition, ARC has a strong history of providing customized market opportunity reports and services to meet your specific needs. For example, you may sell your products only to specific industries and/or in only one or two regions. You tell us your served markets and ARC can quickly configure a report or service designed to best serve your served market.

ARC provides several versions of these reports and services depending on your role in the organization. Executive Views are high level market opportunities designed to help executives quickly identify key trends and market opportunities around the world. In-depth market opportunity analyses provide marketing and product managers more detailed technology specific market information to plan marketing and product development strategies. The following table shows more specific information included in each version.

| Market Growth Outlook Analysis | Use Cases | Target Role |

| Worldwide Market Growth Outlook by Industry & Region with 3-year history where available | In-depth technology-specific strategic growth planning across multiple technologies, applications, regions, and industries | Product & Marketing Managers |

| Worldwide Industry Growth Outlook by Region with 3-year history where available | Strategic technology growth planning for markets defined by a single or multiple vertical industries | Industry Managers |

| Regional/Country Market Growth Outlook by Technology & Industry with 3-year history where available (includes country data) | Strategic technology growth planning for markets defined by a single or multiple world regions | Regional & Country Sales Managers |

| Market Growth Outlook Executive View | Strategic Total Available Market (TAM) growth planning dashboard covering multiple vertical industries, technologies, and world regions | Executives |

ARC’s Competitive Analysis services deliver in depth competitive analyses across multiple technologies, applications, regions, and industries. Besides providing an in-depth analysis of the market opportunity provided by each technology, this service allows technology suppliers to analyze their own customized markets consisting of multiple technologies. For example, customers can view different market scenarios by adding or removing technology markets from the analysis, providing them a Total Available Market (TAM) view of their own served market. A list of the available market growth outlook services can be seen in the list below.

This service is designed to help product and marketing managers identify their company’s market positioning across multiple views within their Serviceable Available Market (SAM). Built upon a proprietary market model and ARC’s field proven primary research, this service helps product and marketing managers optimize their business plans by identifying how their company’s market position would change if the company were to acquire or divest a particular product line or technology. ARC’s reputation as the preeminent independent provider of competitive market benchmarking for nearly four decades lends greater weight to your business plans. ARC’s market competitive services are available in a variety of formats depending on whether you view your market opportunities via different technologies, industries, or world regions.

In addition, ARC has a strong history of providing customized market opportunity reports and services to meet the specific needs of our clients. For example, you may sell your products only to specific industries and/or in only one or two regions. You tell us your served markets and ARC can quickly configure a report or service designed to best serve your served market.

ARC provides several versions of these reports and services depending on your role in the organization. Executive Views are high level market competitive analyses designed to help executives quickly assess their SAM by world region, technology, or vertical industry. In-depth competitive market analyses provide marketing and product managers more detailed technology specific benchmarking information to plan marketing and product development strategies. The following table shows more specific information included in each version.

| Competitive Analysis | Use Cases | Target Role |

| Worldwide Competitive Analysis by Technology | In-depth competitive market analysis that quantifies how your company’s market position has changed over time across multiple technologies, applications, regions, and industries | Product & Marketing Managers |

| Worldwide Competitive Analysis by Industry | Strategic technology-based competitive analyses for markets defined by a single or multiple vertical industries | Industry Managers |

| Regional/Country Competitive Analysis by Industry | Strategic technology-based competitive analyses for markets defined by a single or multiple world regions | Regional Sales Managers |

| Competitive Analysis Executive View | Strategic Serviceable Available Market (SAM) analysis dashboard covering multiple vertical industries, technologies, and world regions | Executives |

Worldwide Research Focus Areas

Strategic Analysis

- Executive Overview

- Market Trends

- Buyer Strategies

- Supplier Strategies

- Growth Contributors and Inhibitors

Competitive Analysis

- Market Shares of Leading Suppliers

- Market Shares by Region

- North America

- Europe, Middle East, Africa

- Asia

- Latin America

- Market Shares by Revenue Category

- Software

- Services

- Market Shares by Application

- Inspection

- Inventory Management

- Leak Detection

- NDT

- Progress Monitoring

- Surveillance/Monitoring

- Surveying & Mapping

- Market Shares by Industry

- Chemical

- Construction

- Electric Power Generation

- Electric Power T&D

- Government

- Mining

- Oil & Gas

- Pulp & Paper

- Refining

- Telecommunications

- Transportation & Logistics

- Market Shares by Customer Type

- Market Shares by Sales Channel

Market Forecasts

- Total Shipments of Drone Inspection Services

- Shipments by Region

- North America

- Europe, Middle East, Africa

- Asia

- Latin America

- Shipments by Revenue Category

- Hardware

- Software

- Services

- Shipments by Application

- Inspection

- Inventory Management

- Leak Detection

- NDT

- Progress Monitoring

- Surveillance/Monitoring

- Surveying & Mapping

- Shipments by Industry

- Chemical

- Construction

- Electric Power Generation

- Electric Power T&D

- Government

- Mining

- Oil & Gas

- Pulp & Paper

- Refining

- Telecommunications

- Transportation & Logistics

- Shipments by Customer Type

- Shipments by Sales Channel

Industry Participants

The research identifies all relevant suppliers serving this market.

Regional Research Focus Areas

Strategic Analysis

Competitive Analysis

- Leading Suppliers in Region

- Industry Shares in Region

- Country Shares in Region

- Leading Suppliers by Industry

Market Forecasts

- Market Forecast by Country

- Market Forecast by Industry

Industry Particiipants

List of countries included in each region: MIRA-Country

For More Information

For more information or to purchase the Drone Inspection Services market research, please contact us.

Learn more about ARC In-depth Research at Market Data Services

Learn more about ARC Strategic Services at Advisory Services for Industry Leaders