This in-depth market data research is split into two key modules: Market Growth Outlook and Competitive Analysis. Each of these modules is further configured into several sub-modules to meet the needs of executives as well as marketing, sales, and product development managers. All of these modules and sub-modules may be purchased as a bundle or separately. A brief description of these modules, sub-modules, and their use cases is included below.

This Total Software Expenditures Market Research delivers current market analysis plus a five year market and technology forecast.

Breakthroughs in Artificial Intelligence Generate Excitement in the Industrial Software Market

ARC Advisory Group research on the industrial software market reveals that with Industry 4.0, we have entered the next phase in the digitalization of the industrial sector. We continue to see integration of intelligent digital technologies, such as Big Data, Industrial IoT, Cloud Computing, and Robotics, into industrial processes. With the on-going shift, software continues to assume increasing importance in industrial automation as a primary means of adding incremental value, increasing competitive differentiation, and advancing customer stickiness. As a result, the industrial software market continues to expand in terms of capabilities as well as market size.

Industrial Software Strategic Issues

In addition to providing a five-year market forecast, the Total Software Expenditures market research provides detailed quantitative current market data and addresses key strategic issues as follows.

In addition to providing a five-year market forecast, the Total Software Expenditures market research provides detailed quantitative current market data and addresses key strategic issues as follows.

Leverage Data and AI

It is becoming increasingly more common for the value of the data generated by individual assets over the course of their lifecycle to be of greater value to the organizations than the asset itself. Unlocking the value of this data is a challenge. Manufacturers are looking at AI as a decision support tool for solving business and operational problems. AI and analytics offer enormous potential to improve performance, but only when people trust what the data indicates. Most field services are reactive, with the user calling for service after the device fails. With predictive maintenance (PdM), a type of condition-based maintenance that involves continuous monitoring of equipment, manufacturers can leverage data, AI, ML and IoT to be proactive with their asset management. A modern FSM application when linked with PdM solution can support automatic technician scheduling. Based on the details on asset health conditions and technician skill sets, modern FSM solutions can leverage AI to recommend the right technician to the scheduler or even match and schedule the technician itself. By adopting AI, issue identification as well the business process for triage can be effectively automated. The proactive repair and high “first time fix rate” (FTFR) by the OEM avoid lost revenues for the manufacturer.

Integrate Different Asset Management Systems

To best realize the benefits of different APM solutions, it is also important to integrate these various systems to leverage all the key asset information and create close-loop solutions. For example, if the PdM system indicates an alarming condition, it is crucial to get that alarm in the EAM system so that the maintenance plan can be executed accordingly. While manufacturers understand the importance of integrating their various asset management solutions, it remains a major challenge in the industry. In a 2021 APM survey conducted by ARC Advisory Group over half of the respondents indicated this to be their top-most challenge. Manufacturers should work closely with system integrators and suppliers to address this challenge.

Embrace Digitalization

While critically important in today’s asset-intensive industries, Industrial IoT and PdM initiatives should be expanded and be viewed as foundational components for digital transformation initiatives. Companies that are just now focusing on digitalization are somewhat behind their peers but are still not too late to get started. ARC encourages manufacturers regardless of the size to get on the train now. New digital technologies can augment asset reliability, maintenance, and operational processes to new levels of performance.

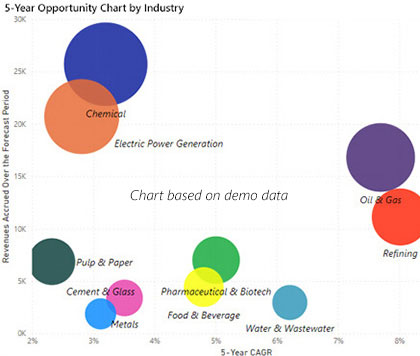

ARC’s market growth outlook service delivers an in-depth market opportunity analysis including five-year market and technology forecasts and 3-year history trend lines where available. Besides providing an in-depth analysis of the market opportunity provided by each technology, this service allows technology suppliers to analyze their own customized markets consisting of multiple technologies. For example, customers can view different market scenarios by adding or removing technology markets from the analysis, providing them a Total Available Market (TAM) view of their own served market. A list of the available market growth outlook services can be seen in the list below.

This service is designed to help accelerate your organization's ability to understand an up-to-date view of the market opportunity provided by your current product portfolio and analyze how your company’s market opportunity would change if you were to acquire or divest a particular product line. The service will also help you identify and capitalize on emerging markets, whether these markets are based on an emerging technology, region, vertical industry, or application. Built upon a proprietary market model and ARC’s field proven primary research, this service helps product and marketing managers optimize their business plans by identifying the opportunities provided by emerging trends. ARC’s reputation as the preeminent independent provider of market growth opportunity analyses for nearly four decades also provides greater weight to your business plans. ARC’s market growth outlook services are available in a variety of formats depending on whether you view your market opportunities via different technologies, industries, or world regions.

In addition, ARC has a strong history of providing customized market opportunity reports and services to meet your specific needs. For example, you may sell your products only to specific industries and/or in only one or two regions. You tell us your served markets and ARC can quickly configure a report or service designed to best serve your served market.

ARC provides several versions of these reports and services depending on your role in the organization. Executive Views are high level market opportunities designed to help executives quickly identify key trends and market opportunities around the world. In-depth market opportunity analyses provide marketing and product managers more detailed technology specific market information to plan marketing and product development strategies. The following table shows more specific information included in each version.

| Market Growth Outlook Analysis | Use Cases | Target Role |

| Worldwide Market Growth Outlook by Industry & Region with 3-year history where available | In-depth technology-specific strategic growth planning across multiple technologies, applications, regions, and industries | Product & Marketing Managers |

| Worldwide Industry Growth Outlook by Region with 3-year history where available | Strategic technology growth planning for markets defined by a single or multiple vertical industries | Industry Managers |

| Regional/Country Market Growth Outlook by Technology & Industry with 3-year history where available (includes country data) | Strategic technology growth planning for markets defined by a single or multiple world regions | Regional & Country Sales Managers |

| Market Growth Outlook Executive View | Strategic Total Available Market (TAM) growth planning dashboard covering multiple vertical industries, technologies, and world regions | Executives |

ARC’s Competitive Analysis services deliver in depth competitive analyses across multiple technologies, applications, regions, and industries. Besides providing an in-depth analysis of the market opportunity provided by each technology, this service allows technology suppliers to analyze their own customized markets consisting of multiple technologies. For example, customers can view different market scenarios by adding or removing technology markets from the analysis, providing them a Total Available Market (TAM) view of their own served market. A list of the available market growth outlook services can be seen in the list below.

This service is designed to help product and marketing managers identify their company’s market positioning across multiple views within their Serviceable Available Market (SAM). Built upon a proprietary market model and ARC’s field proven primary research, this service helps product and marketing managers optimize their business plans by identifying how their company’s market position would change if the company were to acquire or divest a particular product line or technology. ARC’s reputation as the preeminent independent provider of competitive market benchmarking for nearly four decades lends greater weight to your business plans. ARC’s market competitive services are available in a variety of formats depending on whether you view your market opportunities via different technologies, industries, or world regions.

In addition, ARC has a strong history of providing customized market opportunity reports and services to meet the specific needs of our clients. For example, you may sell your products only to specific industries and/or in only one or two regions. You tell us your served markets and ARC can quickly configure a report or service designed to best serve your served market.

ARC provides several versions of these reports and services depending on your role in the organization. Executive Views are high level market competitive analyses designed to help executives quickly assess their SAM by world region, technology, or vertical industry. In-depth competitive market analyses provide marketing and product managers more detailed technology specific benchmarking information to plan marketing and product development strategies. The following table shows more specific information included in each version.

| Competitive Analysis | Use Cases | Target Role |

| Worldwide Competitive Analysis by Technology | In-depth competitive market analysis that quantifies how your company’s market position has changed over time across multiple technologies, applications, regions, and industries | Product & Marketing Managers |

| Worldwide Competitive Analysis by Industry | Strategic technology-based competitive analyses for markets defined by a single or multiple vertical industries | Industry Managers |

| Regional/Country Competitive Analysis by Industry | Strategic technology-based competitive analyses for markets defined by a single or multiple world regions | Regional Sales Managers |

| Competitive Analysis Executive View | Strategic Serviceable Available Market (SAM) analysis dashboard covering multiple vertical industries, technologies, and world regions | Executives |

Worldwide Research Focus Areas

Strategic Analysis

- Major Trends

- Executive Overview

- Buyer Strategies

- Supplier Strategies

- Growth Contributors and Inhibitors

Competitive Analysis

- Market Shares of the Leading Suppliers

- Market Shares by Region

- North America

- Europe, Middle East, Africa

- Asia

- Latin America

- Market Shares by Industry

- Aerospace & Defense

- Automotive

- Buildings

- Cement & Glass

- Chemical

- Construction

- Education

- Electric Power Generation

- Electric Power T&D

- Electronics & Electrical

- Fabricated Metals

- Financial

- Food & Beverage

- Government

- Healthcare

- Household & Personal Care

- Machinery

- Marine

- Medical Products

- Metals

- Mining

- Oil & Gas

- Pharmaceutical & Biotech

- Plastics & Rubber

- Printing & Publishing

- Pulp & Paper

- Refining

- Retail

- Semiconductors

- Telecommunications

- Textiles

- Transportation & Logistics

- Water & Wastewater

- Wholesale & Distribution

- Market Shares by Product

- Advanced Process Control and On-Line Optimization

- Asset Reliability Software & Services

- Engineering Design Tools

- Enterprise Asset Management

- Field Service Management

- Human Machine Interface Software

- Manufacturing Execution Systems for Process

- Manufacturing Execution Systems for Discrete

- Operational Historians-Data Platforms

- Operator Training Simulation Solutions

- Process Simulation and Optimization Software

- Supply Chain Planning

Market Forecasts

- Total Software Expenditures

- Shipments by Region

- North America

- Europe, Middle East, Africa

- Asia

- Latin America

- Shipments by Industry

- Aerospace & Defense

- Automotive

- Buildings

- Cement & Glass

- Chemical

- Construction

- Education

- Electric Power Generation

- Electric Power T&D

- Electronics & Electrical

- Fabricated Metals

- Financial

- Food & Beverage

- Government

- Healthcare

- Household & Personal Care

- Machinery

- Marine

- Medical Products

- Metals

- Mining

- Oil & Gas

- Pharmaceutical & Biotech

- Plastics & Rubber

- Printing & Publishing

- Pulp & Paper

- Refining

- Retail

- Semiconductors

- Telecommunications

- Textiles

- Transportation & Logistics

- Water & Wastewater

- Wholesale & Distribution

- Shipments by Product

- Advanced Process Control and On-Line Optimization

- Asset Reliability Software & Services

- Engineering Design Tools

- Enterprise Asset Management

- Field Service Management

- Human Machine Interface Software

- Manufacturing Execution Systems for Process

- Manufacturing Execution Systems for Discrete

- Operational Historians-Data Platforms

- Operator Training Simulation Solutions

- Process Simulation and Optimization Software

- Supply Chain Planning

Industry Participants

The research identifies all relevant suppliers serving this market.

For More Information

To speak with the author or to purchase the Total Software Expenditures Market Research, please contact us.

Learn more about ARC In-depth Research at Market Data Services

Learn more about ARC Strategic Services at Advisory Services for Industry Leaders