This in-depth market data research is split into two key modules: Market Growth Outlook and Competitive Analysis. Each of these modules is further configured into several sub-modules to meet the needs of executives as well as marketing, sales, and product development managers. All of these modules and sub-modules may be purchased as a bundle or separately. A brief description of these modules, sub-modules, and their use cases is included below.

The industrial PCs (IPCs) market research delivers current market analysis plus a five-year market and technology forecast. It is available in multiple editions including worldwide, all regions, and most major countries. This market research provides a comprehensive analysis of the market for industrial PCs. These are PCs used on the plant floor and are ruggedized to be used in harsh industrial environments.

Order Backlog, AI, and Edge Computing Drive Growth in Industrial PCs Market

ARC market research for Industrial PCs shows that several key trends will drive future demand. These include the exponential emergence of AI applications, as well as the ever-growing use of cloud application platforms and thus IPCs as edge devices to connect to these platforms. Other factors driving future market growth include the increasing product diversity and customization of IPCs as well as the importance of IPCs in retrofitting and upgrading equipment. In contrast to smartphones, controllers/IPCs as automation components have had comparatively leisurely innovation cycles to date. This is increasingly changing for various reasons, including the poor availability of some electronic components due to the semiconductor crisis, new regulatory requirements for cybersecurity, and rising user expectations for AI capability, performance, and convenience.

C Strategic Issues

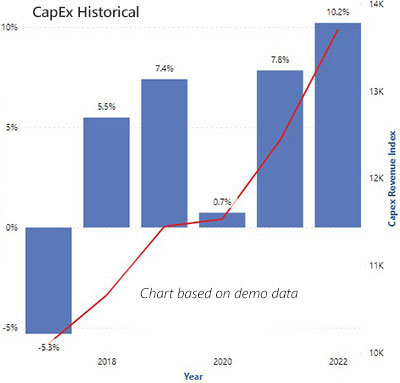

" data-align="right" data-entity-type="" data-entity-uuid="" height="383" src="/sites/default/files/Images/research-images/capex-historical-400px.jpg" width="400"/>In addition to providing a five-year market forecast, the industrial PCs market research provides detailed quantitative current market data and addresses key strategic issues as follows.

" data-align="right" data-entity-type="" data-entity-uuid="" height="383" src="/sites/default/files/Images/research-images/capex-historical-400px.jpg" width="400"/>In addition to providing a five-year market forecast, the industrial PCs market research provides detailed quantitative current market data and addresses key strategic issues as follows.

Ensure Integration and Scalability of Solutions

The openness of IPCs is on the one hand a nice thing to have, on the other side brings some negative aspects with it. It may consist of a threat to security, but it is easy to add functionality to scale up in tasks and include additional aspects such as energy management, access control, condition monitoring, FSM, data connectivity, etc., in one box. OEMs and end users need to challenge their automation suppliers about their roadmap and their overall capabilities in terms of automation and not only in terms of IPC models.

Network Management

Industrial networks are growing more complex. The trend toward greater connectivity is pushing the growth of the number of network participants. Easy and flexible integration makes life easier for end users as well as for system integrators, original equipment manufacturers (OEMs), and IT and OT departments. IPCs play an important role, and users should focus on buying systems that allow easy integration and maintenance.

AI Offerings

Consider AI offerings and the computing capacity needed for certain AI applications and do not forget redundancy.

Explore Modular Production

Thanks to Industrial IoT, future automation architectures will support modular machine construction and distributed control. In the process industries, consortia are developing specifications for machine type packages (MTPs) that support the standardization of modular architectures. The success of standardized modular architectures will likely spill over to most other industries when the business benefits become clear. ARC offers a report on this topic called “Automation for MTP.”

ARC’s market growth outlook service delivers an in-depth market opportunity analysis including five-year market and technology forecasts and 3-year history trend lines where available. Besides providing an in-depth analysis of the market opportunity provided by each technology, this service allows technology suppliers to analyze their own customized markets consisting of multiple technologies. For example, customers can view different market scenarios by adding or removing technology markets from the analysis, providing them a Total Available Market (TAM) view of their own served market. A list of the available market growth outlook services can be seen in the list below.

This service is designed to help accelerate your organization's ability to understand an up-to-date view of the market opportunity provided by your current product portfolio and analyze how your company’s market opportunity would change if you were to acquire or divest a particular product line. The service will also help you identify and capitalize on emerging markets, whether these markets are based on an emerging technology, region, vertical industry, or application. Built upon a proprietary market model and ARC’s field proven primary research, this service helps product and marketing managers optimize their business plans by identifying the opportunities provided by emerging trends. ARC’s reputation as the preeminent independent provider of market growth opportunity analyses for nearly four decades also provides greater weight to your business plans. ARC’s market growth outlook services are available in a variety of formats depending on whether you view your market opportunities via different technologies, industries, or world regions.

In addition, ARC has a strong history of providing customized market opportunity reports and services to meet your specific needs. For example, you may sell your products only to specific industries and/or in only one or two regions. You tell us your served markets and ARC can quickly configure a report or service designed to best serve your served market.

ARC provides several versions of these reports and services depending on your role in the organization. Executive Views are high level market opportunities designed to help executives quickly identify key trends and market opportunities around the world. In-depth market opportunity analyses provide marketing and product managers more detailed technology specific market information to plan marketing and product development strategies. The following table shows more specific information included in each version.

| Market Growth Outlook Analysis | Use Cases | Target Role |

| Worldwide Market Growth Outlook by Industry & Region with 3-year history where available | In-depth technology-specific strategic growth planning across multiple technologies, applications, regions, and industries | Product & Marketing Managers |

| Worldwide Industry Growth Outlook by Region with 3-year history where available | Strategic technology growth planning for markets defined by a single or multiple vertical industries | Industry Managers |

| Regional/Country Market Growth Outlook by Technology & Industry with 3-year history where available (includes country data) | Strategic technology growth planning for markets defined by a single or multiple world regions | Regional & Country Sales Managers |

| Market Growth Outlook Executive View | Strategic Total Available Market (TAM) growth planning dashboard covering multiple vertical industries, technologies, and world regions | Executives |

ARC’s Competitive Analysis services deliver in depth competitive analyses across multiple technologies, applications, regions, and industries. Besides providing an in-depth analysis of the market opportunity provided by each technology, this service allows technology suppliers to analyze their own customized markets consisting of multiple technologies. For example, customers can view different market scenarios by adding or removing technology markets from the analysis, providing them a Total Available Market (TAM) view of their own served market. A list of the available market growth outlook services can be seen in the list below.

This service is designed to help product and marketing managers identify their company’s market positioning across multiple views within their Serviceable Available Market (SAM). Built upon a proprietary market model and ARC’s field proven primary research, this service helps product and marketing managers optimize their business plans by identifying how their company’s market position would change if the company were to acquire or divest a particular product line or technology. ARC’s reputation as the preeminent independent provider of competitive market benchmarking for nearly four decades lends greater weight to your business plans. ARC’s market competitive services are available in a variety of formats depending on whether you view your market opportunities via different technologies, industries, or world regions.

In addition, ARC has a strong history of providing customized market opportunity reports and services to meet the specific needs of our clients. For example, you may sell your products only to specific industries and/or in only one or two regions. You tell us your served markets and ARC can quickly configure a report or service designed to best serve your served market.

ARC provides several versions of these reports and services depending on your role in the organization. Executive Views are high level market competitive analyses designed to help executives quickly assess their SAM by world region, technology, or vertical industry. In-depth competitive market analyses provide marketing and product managers more detailed technology specific benchmarking information to plan marketing and product development strategies. The following table shows more specific information included in each version.

| Competitive Analysis | Use Cases | Target Role |

| Worldwide Competitive Analysis by Technology | In-depth competitive market analysis that quantifies how your company’s market position has changed over time across multiple technologies, applications, regions, and industries | Product & Marketing Managers |

| Worldwide Competitive Analysis by Industry | Strategic technology-based competitive analyses for markets defined by a single or multiple vertical industries | Industry Managers |

| Regional/Country Competitive Analysis by Industry | Strategic technology-based competitive analyses for markets defined by a single or multiple world regions | Regional Sales Managers |

| Competitive Analysis Executive View | Strategic Serviceable Available Market (SAM) analysis dashboard covering multiple vertical industries, technologies, and world regions | Executives |

Worldwide Research Focus Areas

Strategic Analysis

- Executive Overview

- Market Trends

- Buyer Strategies

- Supplier Strategies

- Growth Contributors and Inhibitors

Competitive Analysis

- Market Shares of the Leading Suppliers

- Market Shares by Region

- North America

- Europe/Middle East/Africa

- Asia

- Latin America

- Market Shares by Revenue Category

- Hardware

- Software

- Market Shares by Hardware Type

- 19” Rack Mount

- Blade IPCs/Servers

- Box IPC

- Panel PC

- Customized/Other IPCs

- Market Shares by Software Configuration

- IPCs with OS

- IPCs without OS

- Market Shares by Application

- Automation Tasks

- Edge Tasks

- Combined Tasks

- Edge Server

- Market Shares by Industry

- Aerospace & Defense

- Automotive

- Building Automation

- Cement & Glass

- Chemical

- Electric Power Generation

- Electric Power T&D

- Electronics & Electrical

- Fabricated Metals

- Food & Beverage

- Machinery

- Metals

- Mining

- Oil & Gas

- Pharmaceutical & Biotech

- Pulp & Paper

- Refining

- Semiconductors

- Water & Wastewater

- Market Shares by Edge vs. Non-Edge

- Market Shares by Machinery Segment

- Market Shares by Operating System

- Market Shares by Customer Type

- Market Shares by Sales Channel

Market Forecast and History

- Total Shipments of Industrial PCs

- Shipments by Region

- North America

- Europe/Middle East/Africa

- Asia

- Latin America

- Shipments by Revenue Category

- Hardware

- Software

- Shipments by Hardware Type

- 19” Rack Mount

- Blade IPCs/Servers

- Box IPC

- Panel PC

- Customized/Other IPCs

- Shipments by Software Configuration

- IPCs with OS

- IPCs without OS

- Shipments by Application

- Automation Tasks

- Edge Tasks

- Combined Tasks

- Edge Server

- Shipments by Industry

- Aerospace & Defense

- Automotive

- Building Automation

- Cement & Glass

- Chemical

- Electric Power Generation

- Electric Power T&D

- Electronics & Electrical

- Fabricated Metals

- Food & Beverage

- Machinery

- Metals

- Mining

- Oil & Gas

- Pharmaceutical & Biotech

- Pulp & Paper

- Refining

- Semiconductors

- Water & Wastewater

- Shipments by Machinery Segment

- Shipments by by Edge vs. Non-Edge

- Shipments by Operating System

- Shipments by Customer Type

- Shipments by Sales Channel

- Shipments by Complete IPC Power Consumption

- Shipments by Processor Power Consumption

- Shipments by CPU Brand

- Shipments by Ventilation

Industry Participants

The research identifies all relevant suppliers serving this market.

Regional Research Focus Areas

Strategic Analysis

Competitive Analysis

- Leading Suppliers in Region

- Industry Shares in Region

- Country Shares in Region

- Leading Suppliers by Industry

Market Forecast and History

- Market Forecast and History by Country

- Market Forecast and History by Industry

Industry Participants

List of countries included in each region: MIRA-Country

For More Information

To speak with the author or to purchase the Industrial PCs Market Research, please contact us.

Learn more about ARC In-depth Research at Market Analysis

Learn more about ARC Strategic Services at Advisory Services for Industry Leaders